Why

Financial planning is …

- A critical first step. First plan, and then invest – so you know what you’re investing is about.

- An ongoing habit. Stay the course in volatile markets by keeping your own financial goals relevant over time.

- A personal event. A balancing act across and among your family’s fascinating, challenging, personal, professional and financial circumstances.

Common analysis include (but are not limited to):

- Objective second opinions on existing portfolios (complimentary)

- Retirement planning

- Cash flow and income needs

- College funding

- Insurance planning

- Estate planning

- Evaluating employee benefits

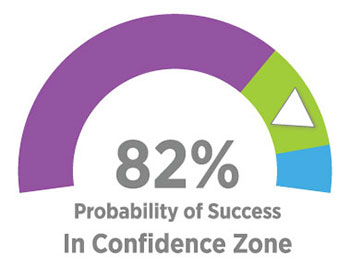

© PIEtech, Inc. Reproduced with permission. All rights reserved.

What

Our financial planning process is …

- Disciplined, so you stay on track to reaching your goals.

- Flexible, to address the particulars you face and not waste your time on those that you don’t.

- Fee-only priced, for transparent and cost-effective value you can measure.

Some real-world examples of planning that we have done:

- Income planning and investment management for a couple retiring early

- The unexpected loss of a spouse

- Evaluating lump sum payouts and early retirement offers

- Estate planning for out-of-state property

- Consolidating random accounts into a coherent investment portfolio

- Managing a large inheritance/estate