Recent History Bias

A portfolio’s effectiveness should be judged on the performance of the overall diversified portfolio. Yet, investors are tempted to focus on the most recent top performing asset class and question their portfolio’s inferior returns. Even though academia has shown us that past performance does not indicate future results, investors fall into the trap of recency bias.

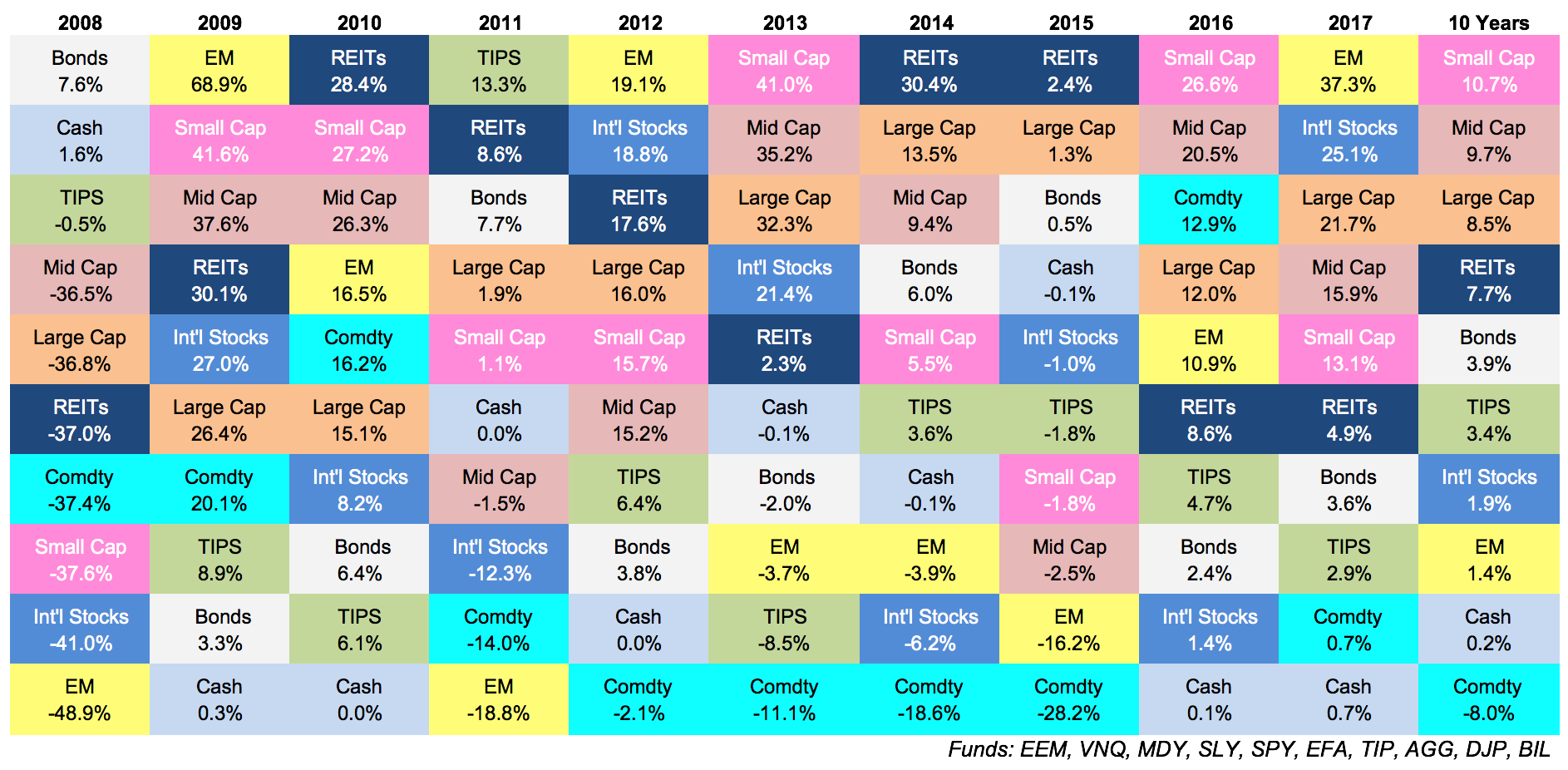

View the chart below. Each asset class is color-coded and is ranked highest to lowest by annual returns for each of the last ten years. If you pick a color (an asset class) and follow it across the time period, you can see that the asset’s rank moves over time and often dramatically.

http://awealthofcommonsense.com/2018/01/updating-my-favorite-performance-chart-for-2017/

See EM, Emerging Markets stock. In 2011 Emerging Markets was dead last, but rebounded to the top asset class in the subsequent year. In the last 5 years, Emerging Markets trailed domestic stock categories for four straight years, but in 2017 Emerging Markets was the best returning asset class by far. If you were an investor influenced by recency bias, you would have missed out on a great buying opportunity.

Instead of predicting which asset class will top the list year after year, we build a strategic asset allocation to capture all of the asset classes. We avoid the regret of not being in this year’s top asset class and mitigate the damage if one asset class falls dramatically. You will never get rich with a diversified asset allocation, but you won’t lose it all either. Diversification is the boring way to invest, but can bring great returns to the long-term investor without the unnecessary risk of a single asset class.

According to Dimensional Fund Advisor’s Matrix Book 2018, a balanced 60% stock/40% bonds portfolio produced a 5.7% annualized return over the last 10 years. That may not seem remarkable unless you consider that the 10 year period starts with the 2008 correction!

It takes self-control and patience to be a successful long-term investor. Markets act randomly. Short-term performance can be misleading and sometimes the best performer continues to be a high ranking asset class for years at a time. Stay disciplined and do not succumb to recency bias.