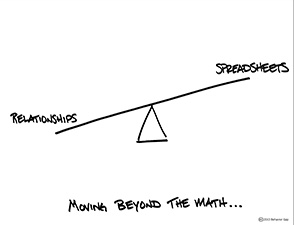

The best solution is a fiduciary works for you and only you. As fiduciaries, we do not make a commission by selling a financial product to you. Our standard of care is your best interest. We are your advisor through thick and thin.

Second best is a broker who makes money from selling products. The salesman will call himself your ‘financial advisor’ until things go sideways and then claim the lower standard of ‘suitability’, as in “this was a suitable product to sell to a person like you and who knew it would go badly?” After all, they are not financial advisors, just salesmen and generally nice guys, too.

Why settle for second best?

- We are fee-only fiduciary advisors and members of the Fee-Only Network.

- We are CERTIFIED FINANCIAL PLANNER TM practitioners.

- We are NAPFA-Registered Financial Advisors who require a fiduciary oath to put clients’ interests above all others in order to qualify for NAPFA membership.

- We are a full service planning firm dedicated to serving your best interest.

- Stowe Financial Planning, LLC is a Registered Investment Advisory.

- Please see Stowe Financial Planning’s ADV Part II legal disclosure or click here to view our Client Relationship Summary disclosure.

Please contact us today to schedule a complimentary meeting to discuss your planning needs.

Bob Stowe, CFP® and Roddy Warren, CFP® are Fee-Only CERTIFIED FINANCIAL PLANNER TM practitioners providing fee-only financial planning services to Plano, Dallas, Frisco, Denton, McKinney, Allen, Carrollton, Lewisville, Garland, Richardson, Prosper and the surrounding DFW area.

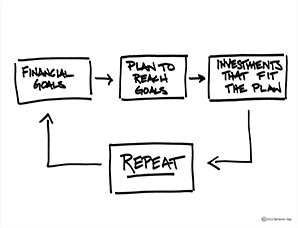

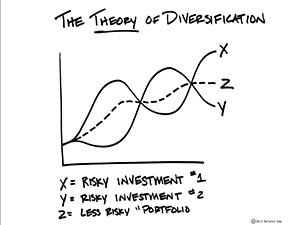

Stowe Financial Planning, LLC specializes in providing objective financial planning to help clients build, manage, grow, and protect their assets through life's transitions. We focus our planning on the issues that matter most to our clients and invest as the plan dictates, which is the only sound path to success. Bob Stowe is a NAPFA-Registered Financial Advisor and member of the Fee-Only Network.