Why

Our relationship with you is …

- Exclusively advisory, exclusively for you. Our advice is based on getting to know you well, and always serving your highest financial interests accordingly.

- Targeted. We help retiring or near-retirement corporate executives and similar professional families enhance the quality of their lives by offering a disciplined approach to planning, investing and staying on track toward their personal financial goals.

- Experienced. Founded in 2001 in the wake of 9/11, we’re passionate about helping our clients organize, clarify and strengthen their financial affairs throughout the never-ending barrage of global market events.

- Enjoyable. Beyond just achieving your life’s goals, we want you to enjoy the experience along the way.

fiduciary

noun fi·du·cia·ry \fə-ˈdü-shə-rē, -ˈdyü-, -shē-ˌer-ē\

- one often in a position of authority who obligates himself or herself to act on behalf of another (as in managing money or property) and assumes a duty to act in good faith and with care, candor, and loyalty in fulfilling the obligation.

What

To reinforce our client relationships, we are …

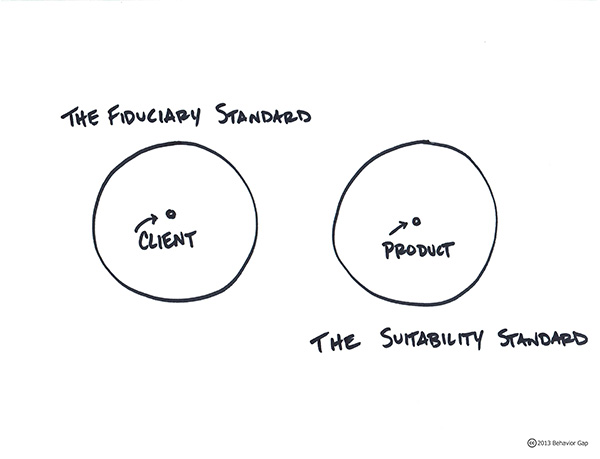

- Your fiduciary advisor, which means we are legally obligated to know and always act in your highest financial interests. Non-fiduciary, “suitable” advice is often flawed by outside interests and unfamiliarity with your circumstances.

- A Registered Investment Advisor firm, which further defines our role as an overarching supporter of your financial affairs. Our advice is never secondary to your spreadsheets; it’s central to your life.

- Fee-only, and affiliated with fee-only organizations, so our compensation comes exclusively from you, our client. Refusing any conflicting, third-party incentives helps further align our interests with your own.

- Plain-spoken Texans, who will tell it to you like it is. As a partner in your financial future, we’ll skip the technical jargon, so you can make informed decisions about your personal wealth.

For more information, please view our responses to NAPFA’s 'Tough Questions to ask a Planner' or read our article on "Finding Right-Fitting Advice".